Payroll program (Optimistic : Payroll)

Fusion Solution provides Payroll program Optimictic implementation services according to Microsoft Partner and CMMi3 standards. With over 16 years of experience, the company has a development team of more than 150 people, divided into various departments, allowing the team to have specialized expertise.

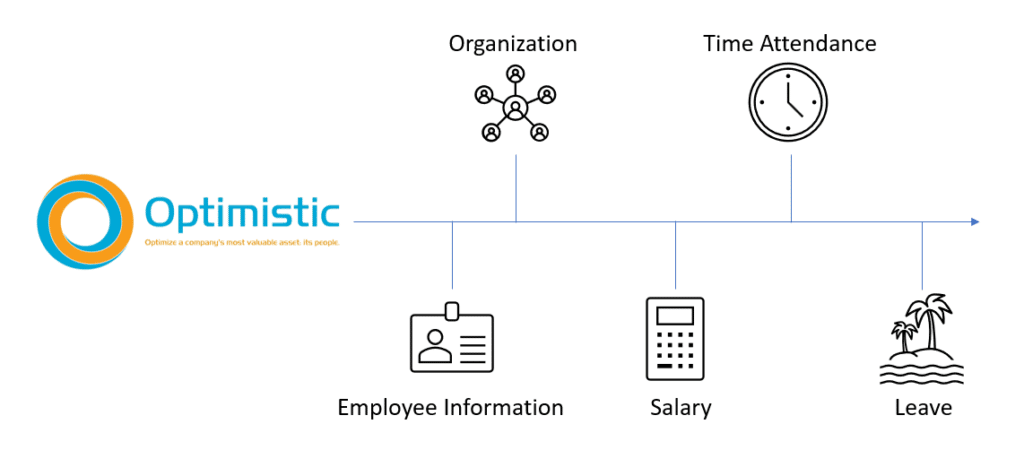

It is a payroll and wages calculation program that can easily set up methods for paying daily and monthly wages, as well as calculating various tax forms to suit each business. The system is designed to be very flexible in use. It can create unlimited databases, supports many types of businesses, and has various necessary reports for sending to external agencies and for use within the company.

The requirements of today's payroll programs have changed significantly from the past, whether it's the form format that has changed from paper to digital files, data transmission to mobile phones, or the payroll program having a screen for employees.

Highlights of Fusion Solution Payroll Program

- It is a responsive system that adjusts the screen size of the payroll program to suit the device.

- There is a mobile payroll system for employees.

- Can link external applications to send data to the payroll program, helping to reduce keying in the HR department.

- What if Analysis system analyzes the impact of salary changes

- Salary Adjustment Planning System

- Connect to Deep Solution system to analyze employee behavior such as work ability, reasons for employee resignation, and overwork.

Payroll Program Service by Fusion Solution

- Get Requirement and Design Solution

- Configuration System

- Consulting

Optimistic Payroll Program | Payroll Features

- Supports calculation of all types of employee income

- Divide all types of payment installments

- Can calculate income tax

- No need to print pay slips because the information is sent directly to the employee's mobile app.

- Calculate various deductions such as social security contributions and provident fund contributions.

- Print payslips and various reports such as Por.Ngor.Dor.1, Por.Ngor.Dor.1Kor, Por.Ngor.Dor.91, withholding tax certificate, S.P.S.1-10.

- Export data to disk for salary payments via various banks.

- Supports changes to various settings that may change in the future, such as tax tables, deduction rates, social security contribution rates, etc.

- There is an advanced security system comparable to the banking system using Digital Signature Technology to record data.

- Connect with the U-Place system for off-site work and the payroll program as one unit.

- Able to manage various functions of the company such as different cut-off cycles of salary, overtime, bonus, allowance, etc.

- Collect data at specified intervals (monthly, bimonthly, daily, hourly).

- Create calculation formulas for various incomes, overtime pay, leave entitlements, and deductions.

- Set permissions to use the payroll program to assign tasks to departments in the company and affiliated companies according to users.